Best Credit Cards of 2025: Top Picks by Category

Best Overall Credit Card

Wells Fargo Active Cash® Card

- 2% flat cash back on all purchases—double the average card rate

- No annual fee and $200 bonus after spending $500 in the first 3 months

- Great intro offer: 0% APR for 12 months on purchases and balance transfers

✈️ Best Travel Rewards Card

Chase Sapphire Preferred® Card

- High welcome bonus (~60,000 points) and strong travel redemption options

- Moderate annual fee (~$95)

- Ideal for frequent travelers valuing flexibility and premium benefits

💵 Best Cash‑Back Card

Citi Double Cash® Card

- Earns a total of 2% cash back: 1% on purchase + 1% on payment

- No annual fee—simple, consistent rewards

🛢️ Best for Gas & Groceries

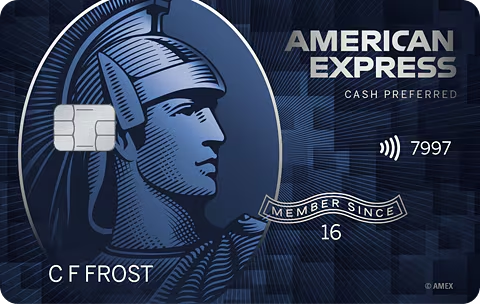

Blue Cash Preferred® Card from American Express

- 6% cash back at U.S. supermarkets (up to $6,000/yr), 3% on gas and transit

- $0 annual fee for the first year, then $95

💳 Best for 0% APR

U.S. Bank Shield™ Visa® Card

- 0% APR for 24 months on purchases and balance transfers

- $0 annual fee and up to 4% cash back on travel booked through its portal

✅ Best for Bad Credit

Discover it® Secured Credit Card

- No annual fee, 1–2% cash back, and rewards are matched at year-end

- Ideal for rebuilding credit with responsible use

👌 Best for Limited/No Credit

Petal 2 Visa® Credit Card

- 1–1.5% cash back, no annual fee, designed for those without strong credit history

🎓 Best Student Card

Capital One Savor Student Cash Rewards Card

- 1–8% cash back on everyday purchases

- $0 annual fee, $50 bonus after first 3 months

🧭 Choosing the Right Card

- Evaluate your spending: travel, groceries, gas, or everyday purchases

- Consider fees vs. benefits: some high-fee cards offer premium rewards

- Intro APR offers: great for financing big purchases or transfers

- Your credit score matters: approval chances vary with card tier

Many users benefit from a multi-card strategy—pairing a flat-rate cash-back card with a bonus-category rewards card or a 0% APR card for flexible finances.